Get Home Equity to Work for You with a Reverse Mortgage Loan

A Refinance Done Right Can Add Security, Confidence, and Flexibility to Your Financial Plan- Create a financial safety net that not only prepares you for the unexpected but also opens the door to living a more comfortable and fulfilling lifestyle.

- Free up your monthly cash flow by refinancing into a reverse mortgage loan, eliminating required mortgage payments, and giving you the flexibility to enjoy retirement on your terms.

- Work with Signet Reverse Mortgage to explore options tailored to your goals. With personalized guidance and decades of expertise, we’ll help you make the most of your home equity.

Your home equity is often your largest asset—exploring options needs to be done with care.

-

*

Sometimes Doing Nothing Is the Right Choice.

We take the time to explore all your options—whether that’s a reverse mortgage loan, a HELOC, or a conventional refinance—to ensure the decision aligns with your financial goals and future needs. -

*

Mortgage Choices Can Be Overwhelming—We Move at Your Pace.

With so many options, it’s easy to feel unsure about the right path. We’ll guide you patiently, helping you understand your choices without pressure, so you can feel confident moving forward. -

*

Access to All the Leading Reverse Mortgage Options.

We partner with the nation’s top reverse mortgage companies, giving us the ability to present a range of solutions tailored to your unique goals and circumstances.

Refinancing your home equity is a significant decision. With our expertise and resources, we’ll help you navigate the process and find a solution that fits your goals and gives you peace of mind.

We Make Your Reverse Mortgage Loan Refinancing Process Easy

- Move forward with confidence and financial security.

- Explore options tailored to your goals, from creating a financial safety net to freeing up cash flow.

- Refinancing can help you simplify your finances and enhance your lifestyle.

- Eliminate monthly mortgage payments while accessing your home equity.

- Simplify the process and know you’re making the right choice with expert guidance.

We Help You Determine if Refinancing Is the Right Choice—For Now and the Future

- There are many reasons a reverse mortgage loan refinance may make sense, from accessing home equity to creating financial flexibility. But navigating the process can feel overwhelming, especially when it’s not always clear what option best supports your goals.

- You’ve found a guide you can trust to help you through the process. I’ll handle your transaction with care, ensuring your decision aligns with both your short- and long-term objectives.

- With over 20 years in lending, coupled with another 20 years as a CPA and experience in corporate finance, I bring a unique perspective that blends life, finances, taxes, and a genuine passion for helping you safeguard your future.

What Our Clients Have to Say

"Clay has helped me purchase and refinance my last two homes. He and his staff are very knowledgeable and a pleasure to work with. I have recommended Signet Mortgage to several friends and family and will continue to call them first for anything related to my home mortgage."—David K., July 11, 2023

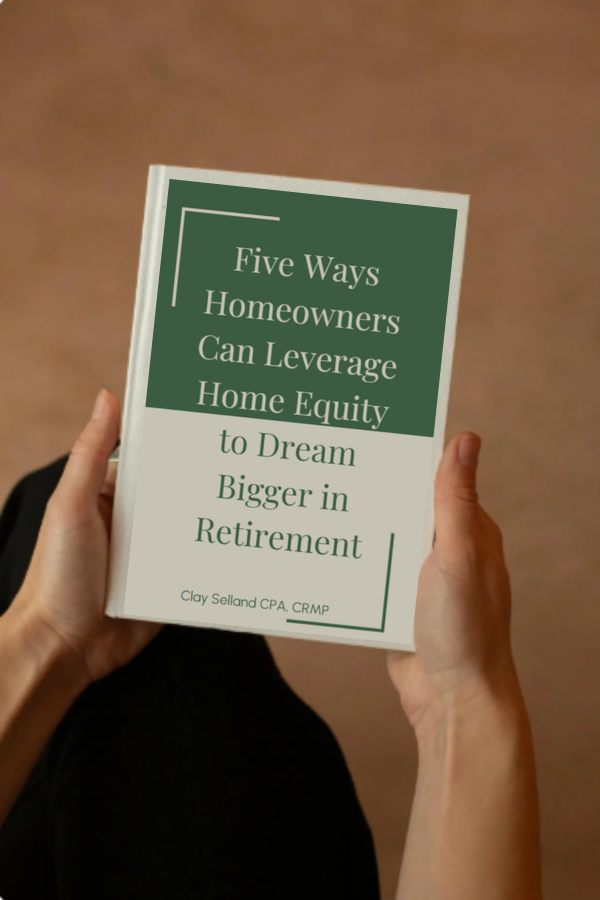

DOWNLOAD YOUR FREE GUIDE:

5 Ways Homeowners Can Leverage Home Equity to Dream Bigger in Retirement

DOWNLOAD YOUR COPYYou have options - Refinance for any purpose

- Pay off your existing mortgage to eliminate monthly payments

- Create a growing line of credit for financial flexibility and peace of mind

- Remodel or improve your home to meet changing needs

- Supplement your income to retire comfortably and enjoy life

- Consolidate debt to simplify finances and reduce stress

- Cover unexpected expenses with ease

Get your refinance done and

done without drama

-

Schedule a conversation

Clay will review your particular situation and share choices and opportunities to meet your objective. -

Move forward with confidence

Work together to secure the terms of your new loan, communicating at all stages and avoiding surprises or drama. -

Choose your best option and relax

Put your refinance in the rear view mirror, secure in the knowledge you found the right guide to make it happen.

What happens when you choose to work with Signet Reverse

At Signet Reverse Mortgage, we understand that it can be challenging to feel confident your finances will handle the ups and downs of retirement. With personalized attention and expert guidance, we help our clients move from feeling stressed and uncertain to achieving financial flexibility and accomplishing more than they ever dreamed possible.

Create a financial safety net that not only prepares you for the unexpected but also opens the door to living a more comfortable and fulfilling lifestyle.

Create a financial safety net that not only prepares you for the unexpected but also opens the door to living a more comfortable and fulfilling lifestyle.

Free up your monthly cash flow by refinancing into a reverse mortgage loan, eliminating required mortgage payments, and giving you the flexibility to enjoy retirement on your terms.

Free up your monthly cash flow by refinancing into a reverse mortgage loan, eliminating required mortgage payments, and giving you the flexibility to enjoy retirement on your terms.

Work with Signet Reverse Mortgage to explore options tailored to your goals. With personalized guidance and decades of expertise, we’ll help you make the most of your home equity.

Work with Signet Reverse Mortgage to explore options tailored to your goals. With personalized guidance and decades of expertise, we’ll help you make the most of your home equity.

Schedule a conversation

Schedule a conversation Move forward with confidence

Move forward with confidence Choose your best option and relax

Choose your best option and relax